Already Own A Business in Dubai?

Streamline Your Operations With Our Full Suite Of Services

(ZERO VISA)

(ONE VISA FREE FOR LIFE)

(ONE VISA)

Free Business & Bank Account Consultation, Free Tax & VAT Consultation, MoA and a Dedicated Account Manager is Included!

Streamline Your Operations With Our Full Suite Of Services

Riz & Mona Consultancy is renowned as one of the top business setup consultants in Dubai, with over 15 years of experience facilitating a wide range of businesses throughout the UAE. Our deep connections with government officials and key authorities, combined with our extensive expertise in consultancy, streamline the process of establishing your business in Dubai. Additionally, we offer comprehensive financial, legal, and corporate services to support our clients throughout their business endeavors.

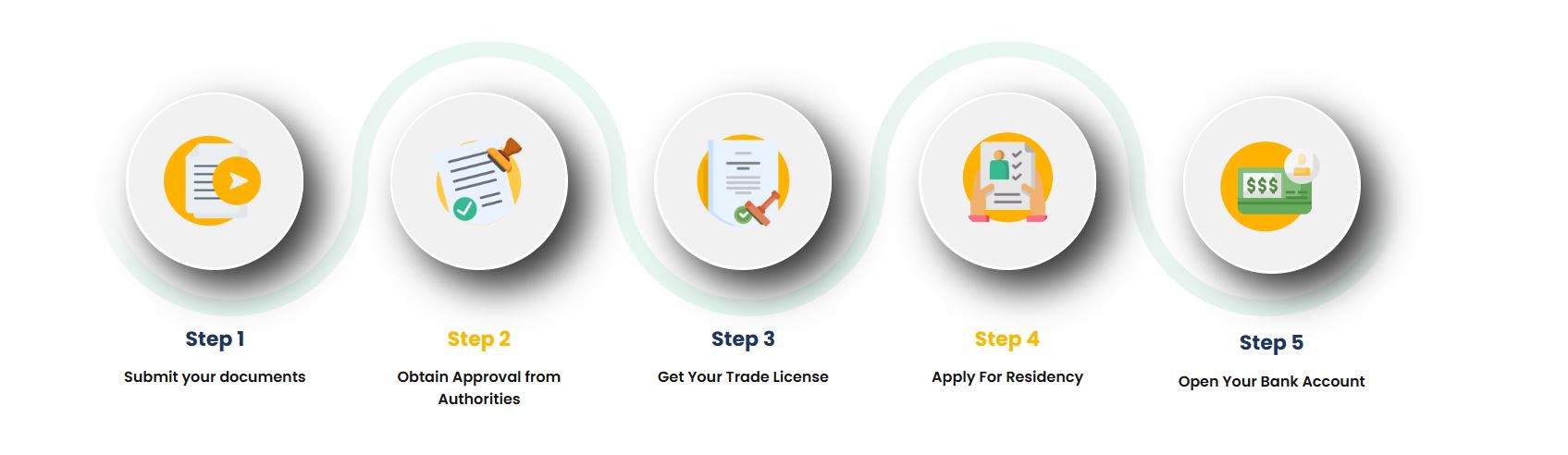

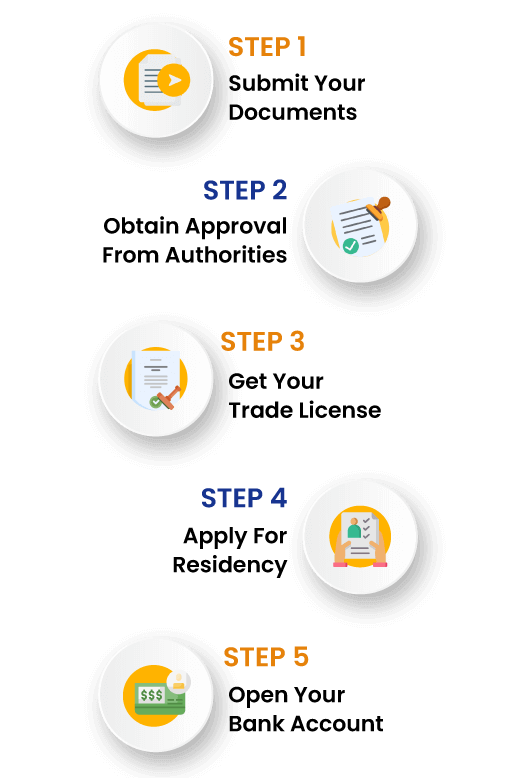

We are here to provide comprehensive support for your Business Setup in Dubai, from preparing your documents to completing the process. Connect with us now to begin your journey with a FREE consultation!

Yes, in many sectors, you can own 100% of your business. Free zones always allow 100% ownership, while mainland businesses in some sectors now permit full foreign ownership under recent reforms.

Dubai offers several types of business licenses, including commercial, professional, industrial, tourism, agricultural, craftsmanship, real estate, media, healthcare, and offshore licenses, each catering to specific business activities and regulated by relevant authorities.

No, options like Flexi Desk permits, third-party agent addresses, or free zone licenses allow businesses to operate without a dedicated office.

Request a Callback.

Would you like to speak to one of our Business Setup Consultants over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.

I would like to discuss about: