Dubai Industrial City (DIC) is one of the largest industrial hubs in the UAE, strategically located near Jebel Ali Port and Al Maktoum Airport, ensuring seamless access to major transport routes. Ideal for businesses in logistics, food and beverage, machinery, and transport equipment, DIC offers 100% foreign ownership, tax exemptions, and access to industrial land and warehouse facilities. With flexible setup options like open yards and LLC structures, it serves as a top destination for industrial ventures.

If you’re exploring other opportunities, Dubai Silicon Oasis is ideal for tech-driven businesses, while Dubai Airport Free Zone (DAFZA) is a strong hub for global trade and logistics.

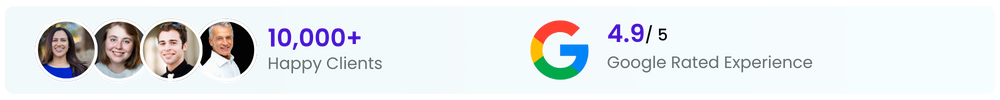

At RIZ & MONA Consultancy, we help entrepreneurs set up their businesses in Dubai Industrial City with expert guidance.